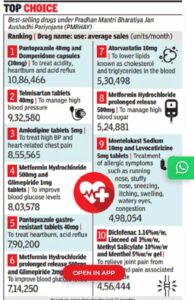

We all recently read this bit of information in newspapers on sale of medicines at Jan Aushadhi Kendras all over the country. To those unaware, these JAK offer a wide range of medicines in their generic form at low affordable prices. There are over 7,800 JAK in India at present. This data gives us insight into average units sold per month for various categories of medicines. It is notable and logical that almost all the top selling medicines are in respect of lifestyle diseases. Among the top 10 drugs, 2 are for treating high blood pressure, 3 for blood sugar, 2 for acidity, 1 for cholesterol and 1 for arthritis. All of these are chronic lifestyle related diseases requiring lifelong medical treatment.

These lifestyle related diseases such as diabetes, cardio vascular, cancer, etc. account for 60% of all deaths in India. India ranks second globally for diabetic patients with over 77 million cases. As per a recent study, 6 out of every 10 Indians had abnormal levels of bad cholesterol. A WHO study estimated that 25% of Indians suffer from hypertension, but only 12% of them have it under control.

When one gets a random piece of data like this, as an investor one starts thinking about its commercial impact. No doubt the lifelong requirement to be under medication puts a huge stress on the finances of the common man and this is precisely what the JAK seeks to alleviate. Moreover, if one takes this data as a representative of the medical issues of Indian people, similar sales must be happening at non-JAK medical shops as well. To put a different spin on it there are several categories of businesses that cater to this need: a) pharmaceutical companies that manufacture these formulations b) API companies that produce the active pharma ingredients that go into these formulations c) medical shops/ pharmacies/ on-line pharmacies- these are the ones easiest to identify. It is also a fact that most lifestyle diseases can degenerate into other life threatening events such as cardiac failure, kidney failure, brain stroke, etc. These in turn will lead to greater number of surgeries at hospitals.

Based on the medicines sold we can see that the following APIs would be in great demand: a) Pantoprazole b) Telmisartan c) Amlodipine d) Metformin e) Glimepiride f) Atorvastatin. We need to look for the companies that make these drugs. The following table shows the API players among the listed companies manufacturing these APIs:

| Sr No | Name of API | Companies that manufacture the API |

| 1 | Pantoprazole | IOL Chemicals & Pharma, Dr Reddy’s, Solara Active Pharma, Mankind Pharma, Sun Pharma |

| 2 | Telmisartan | Mankind Pharma, Dr Reddy’s, Glenmark Life, Divis Lab, Cipla, Ipca Lab, Lupin |

| 3 | Amlodipine | Zydus, Cadilla Pharma, Alkem Lab |

| 4 | Metformin | IOL Chemicals & Pharma, Aarti Drugs, Wanbury, Wockhardt |

| 5 | Glimepiride | Dr Reddy’s, Glenmark Life, Indoco Remedies, Sun Pharma, Dishman |

| 6 | Atorvastatin | Dr Reddy’s, Mankind Pharma, Cadilla Pharma, Torrent, Sun Pharma, Morepen |

(Please note this list is not exhaustive. Source: company data, media)

Similarly these are leading brands of the above generic drugs sold by listed pharma companies

| Sr No | Name of API | Formulation Brands and Companies that manufacture these |

| 1 | Pantoprazole | Pan D (Alkem), Pantocid (Sun Pharma), Pantodac (Zydus), Pansec (Cipla), Pantakind (Mankind) |

| 2 | Telmisartan | Telma (Glenmark) Telmikind ( Mankind), Telsartan ( Dr Reddy’s), Telsar (Torrent), Tellzy (Alembic) |

| 3 | Amlodipine | Stamlo (Dr Reddy’s), Amlokind (Mankind), Amlip (Cipla), Amlogard (Pfizer) |

| 4 | Metformin | GLuconorm (Lupin), Cetapin (Sanofi), Okamet (Cipla), Metsmall ( DR Reddy’s), Formin (Alkem) |

| 5 | Glimepiride | Amaryl (Sanofi), Glimestar (Mankind), GLimy (Dr Reddy’s), Azulix (Torrent), Glimda (Cipla) |

| 6 | Atorvastatin | Storvas ( Sun Pharma) Stator (Abott) Atorlip (Cipla) Atocor (Dr Reddy’s) |

(Please note this list is not exhaustive. Source: company data, media)

But we also need to see how this scenario has unfolded. There are several listed companies with businesses that have been alleged to contribute to these lifestyle diseases, please note this is neither a critique nor an advisory with regard to any of these companies. It is just pointing out the facts that may have resulted in a jump in consumption of these medicines. Among them we can count QSR companies (viz. Westlife, Jubilant Food, Sapphire, Restaurant Brands, Devyani) Beverage companies (Varun Beverages) or Snack Food companies (Bikaji Foods, Prataap Snacks) The sales growth of these companies over the last 5 years is as under:

| Sr No | Name | 5 year sales CAGR |

| 1 | Varun Beverages | 27% |

| 2 | Bikaji Foods | 20% |

| 3 | Prataap Snacks | 10% |

| 4 | Jubilant Foodworks | 11% |

| 5 | Devyani Internationals | 22% |

| 6 | Westlife | 15% |

| 7 | Sapphire Foods | 19% |

| 8 | Restaurants Brands | 31% |

(Source: screener.in)

So when one looks at the phenomenon of rising sales of lifestyle drugs in India, it is actually an effect of second order. The cause or primary effect is the phenomenal rise in sales of QSR, Snacks and Beverage companies. Obviously this is not something that can be resolved overnight. And each of these categories of companies viz. QSR, Snack foods, Beverages, API and Pharma companies will continue to see higher sales, supported by the Indian demographics, rising urbanization and growing spending power for the next several years.

(This is not a recommendation to invest in any of the companies mentioned in this article. The author may have some position in one or more stocks mentioned above.)